The reason debt collectors call you is that they believe you have an outstanding debt. Medical collections aren’t as harmful to your credit: Although medical bills do affect your credit score if they’re sent to collections, in newer credit scoring models developed by FICO and VantageScore (specifically FICO 9 and VantageScore 4.0), medical collections don’t hurt your credit score as much as non-medical collections.

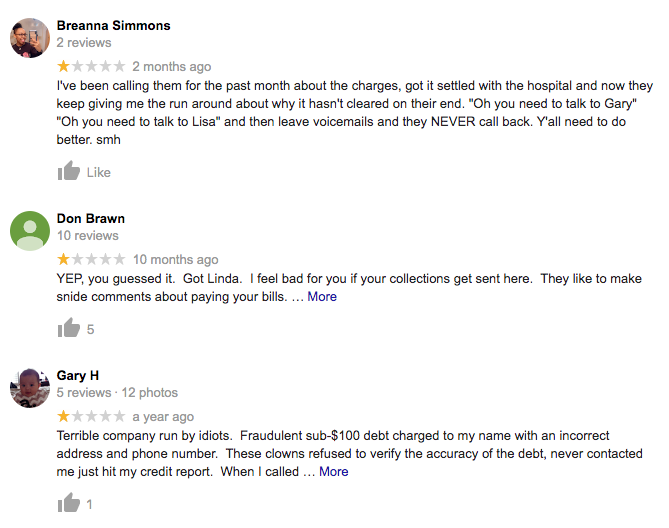

For this reason, the fact that your debt is showing up on your credit report may indicate that it was sold to a company that does report to the bureaus, although it’s possible the medical institution simply hired them as well. AWA Collections might own your debt: Medical institutions don’t generally report to the credit bureaus.1 After that, the credit bureaus wait an additional 1 year before adding the collection account to your report to give you time to make arrangements with your insurance company or set up a payment plan. Your debt is already more than a year old: Medical institutions usually wait 60–120 days before selling your debt to debt collectors.If you see medical debt on your credit report, there are a few implications you should be aware of: Medical and non-medical collections have some key differences in terms of how the debt is handled by debt collection agencies, the credit bureaus, and the main scoring models. non-medical collectionsĪWA Collections often deals with medical bill collections. To do so, contact AWA Collections directly using the contact information below. For this reason, it’s important to verify any debts you’re contacted about. Moreover, scammers may impersonate representatives from AWA Collections to try to collect payments from you. Like many debt collection agencies, AWA Collections has received numerous complaints. However, that doesn’t mean that AWA Collections won’t violate your rights.ĪWA Collections isn’t accredited by the Better Business Bureau, and they’ve been given an “F” rating.

They’re a legitimate debt collection agency. Debts associated with police, fire, or ambulance services.Statutory and criminal fines, including for property damage.Specifically, AWA Collections collects the following types of debt: In particular, AWA Collections provides the following debt collection services:ĪWA Collections collects debt on behalf of the US government and various businesses, including financial institutions (such as banks and lenders), health care companies, telecommunication companies, and utility providers.

#Awa collections agency how to#

0 kommentar(er)

0 kommentar(er)